We use cookies to ensure that we give you the best experience on our website. If you click "Accept Cookies", or continue browsing, you consent to their use. To learn more about how we collect and use cookies, please read our Cookies Policy.

Raising awareness of one of Saudi Arabia’s largest ever IPOs

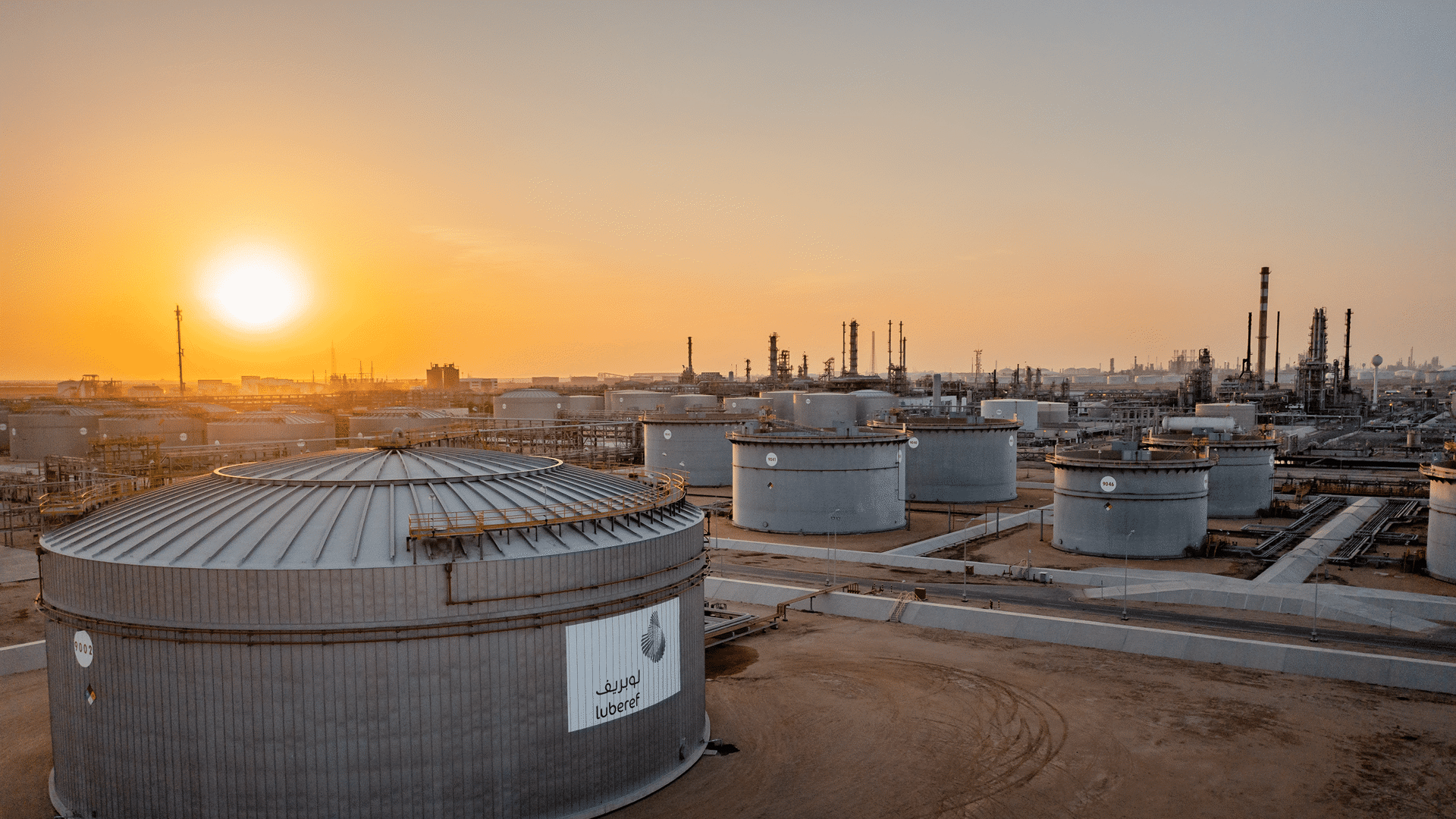

Saudi Aramco Base Oil Company – Luberef is one of the world’s leading suppliers of high-quality base oils and the only virgin base oil producer in the Kingdom of Saudi Arabia. Luberef, which was previously jointly owned by Saudi Aramco and Jadwa Industrial Investment Company, undertook an initial public offering (IPO) in 2022 with the ambitious goal of becoming one of the largest IPOs ever on the Saudi Exchange (Tadawul). This included a retail offering of 25% of issued share capital.

Build positive awareness of this B2B brand and its IPO among key target audiences, and secure interest from retail investors in subscribing for the 25% retail offering.

As part of our multi-phased, strategy, we assessed Luberef’s digital readiness and prepared its digital communication infrastructure ahead of the transaction. This involved overseeing the redevelopment of the corporate website, revamping social media content, and launching a KSA-wide awareness campaign. We also developed an overarching narrative early in the process, amplifying it through traditional mediums, social media, paid partnerships, and influencers.

- Advisory & Strategy

- Research & Analysis

- Insights & Measurement

- Products & Tech

- Brand & Experiences

- CX & Transformation

- Campaigns & Media

- Creative & Production

Supplemented the IPO communications strategy with a digitally focused marcomms plan

We mapped out the enhancement of Luberef’s digital presence and communications channels ahead of the IPO and provided digital marketing advisory before, during, and after listing.

We also plotted a strategic route to growing Luberef’s audience base across the company’s social media channels. In doing so, we ensured key messages and transaction milestones were communicated effectively.

Leveraged paid media and influencers to engage and excite retail investors

Ahead of the transaction, we launched a Saudi Arabia-wide brand awareness campaign on Twitter and LinkedIn to familiarize key audiences with the Luberef brand and its strong position as a leading B2B base oils supplier – driving traffic to its revamped website.

During the transaction, we utilized paid tactics and strategically selected capital market influencers, to maximize the reach of key messages and investment highlights in support of achieving the 25% retail investor subscription target.

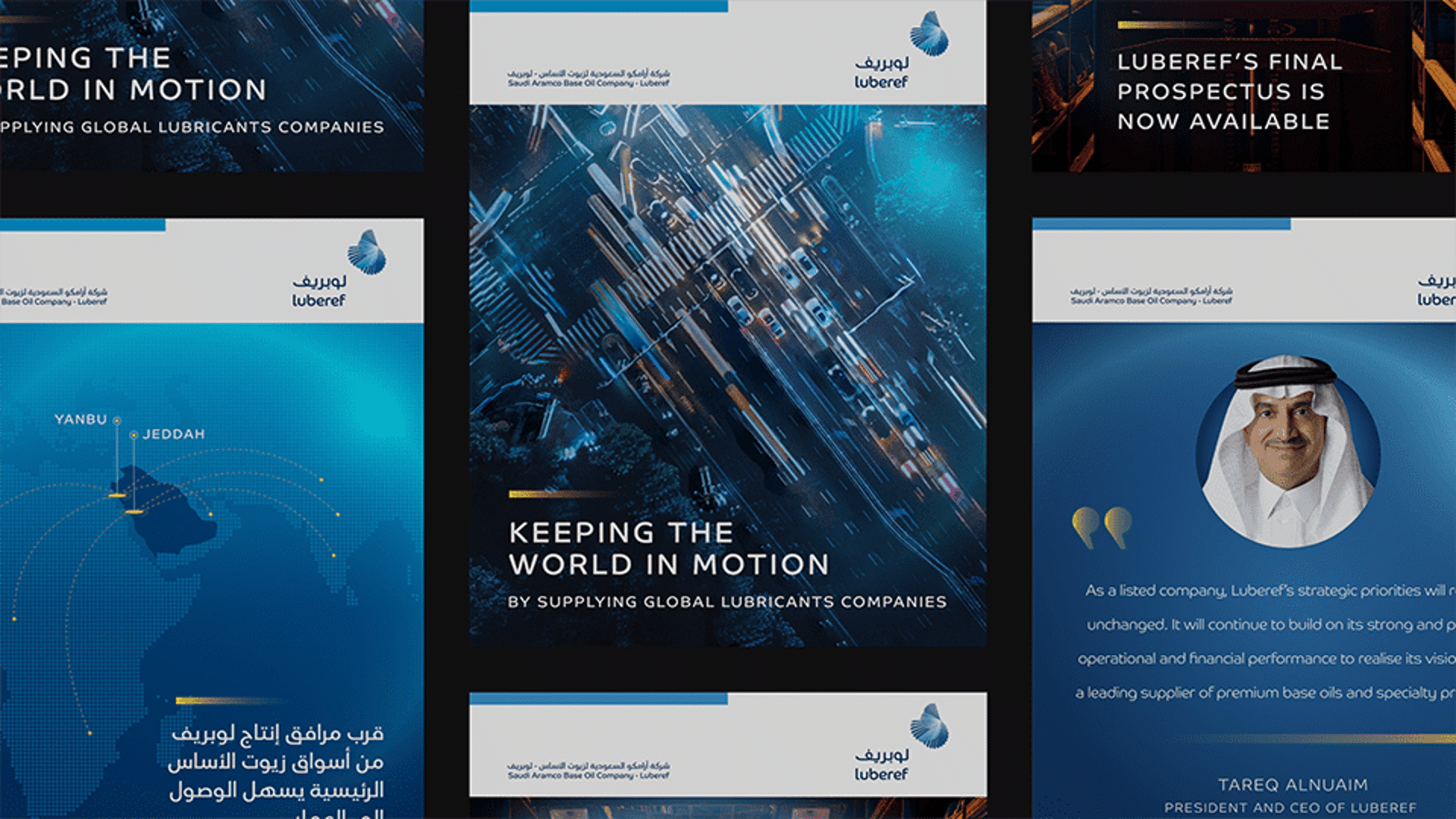

Impactful visuals reinforced the appeal of the transaction

Our in-house creative studio helped visualize key transaction messages throughout the IPO across various multimedia formats. Creative output ranged from uplifting Luberef’s visual style and developing impactful social media posts, to producing leadership and corporate videos that highlighted the company’s attractive investment case.

Led the development of Luberef’s web presence and infrastructure

We ideated and planned the revamp of Luberef’s corporate website, including the launch of the investor relations section on listing. We developed the information architecture and bilingual multimedia content, while managing the client’s web development team and financial data feed provider.

We also created a purpose-built IPO microsite to function as the central information hub for the transaction.